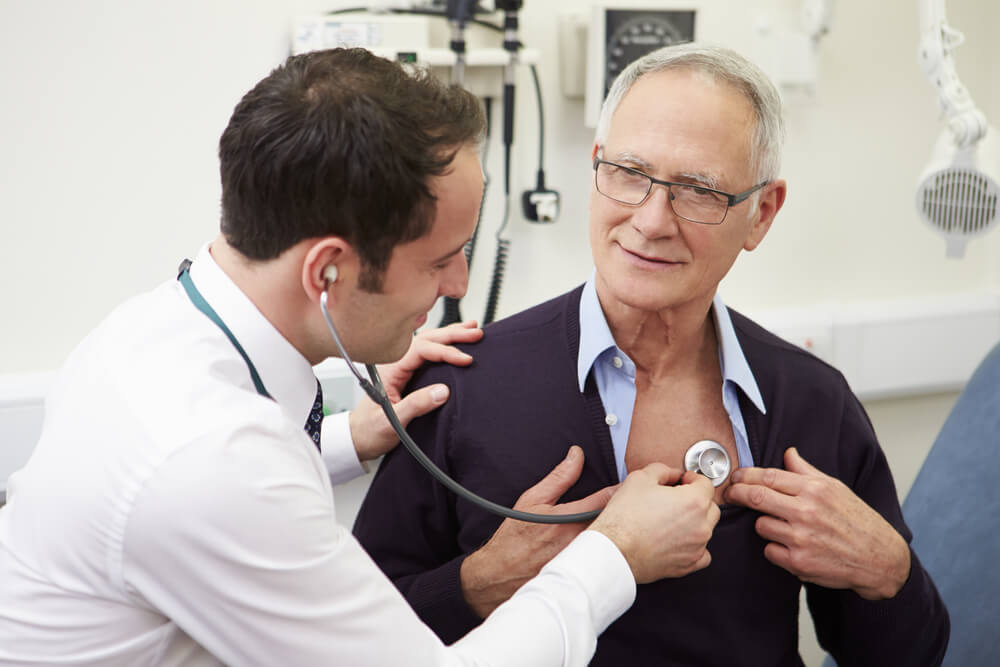

Part of the underwriting process for life insurance policies requires you to take a medical exam. The health classification you get is primarily determined by your current health status as well as your medical history. Your health classification, in turn, impacts the life insurance rates you’ll pay. Getting favorable results in your medical exam translates Read More